Firstly, what cryptocurrencies are?

Cryptocurrencies is a type of currency that exists virtually rather than physically. It’s also considered a digital asset such as gold in the physical realm. The cryptocurrencies came from mining. Transaction can be done by anyone in the world as it works peer-to-peer system meaning decentralized. Cryptocurrencies operates with blockchain technology which records all the transactions all over the network of computers. The decentralized will ensure secure transactions as well.

In this context, small businesses stand to gain significant advantages by embracing cryptocurrencies within their operations. Here we will explore the top five reasons why integrating cryptocurrencies can benefit small businesses, addressing common concerns.

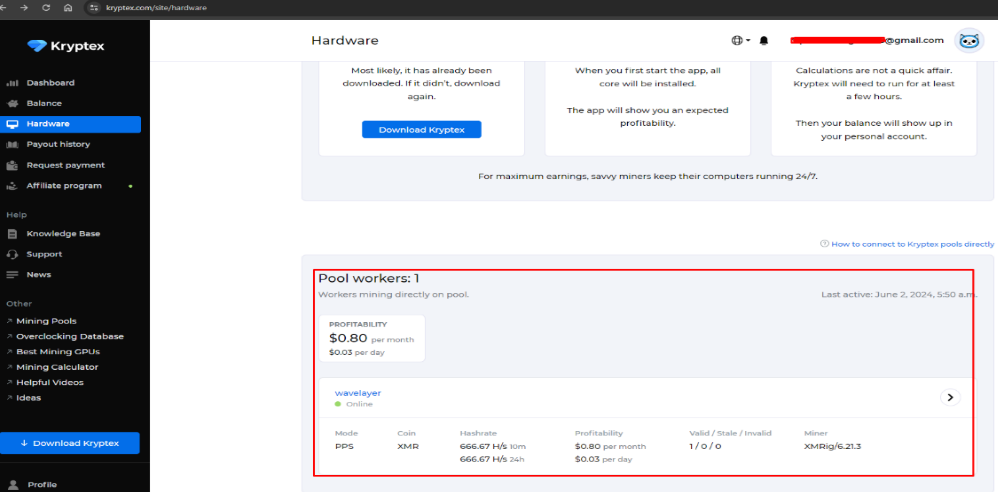

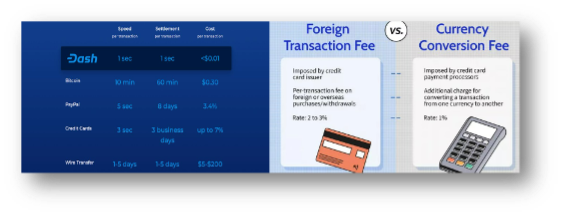

1) Lower Transaction Fees

In traditional payment methods, like credit cards and bank transfers, have high transaction fees (2% to 5% per transaction) when transacting internationally. These include fees associated with using an intermediary bank, processing fees, currency conversion fees, cross-border regulations, risk mitigation costs, and a lack of market competition. For both organizations and people, these fees have the potential to greatly raise the transaction’s total cost. Hence, cryptocurrencies can significantly reduce these fees, saving small businesses money on each transaction.

2) Faster Transaction

With the use of decentralized networks, cryptocurrency transactions do not require middlemen like banks. Because of its decentralized structure, peer-to-peer structure, rapid settlement, shortened processing times, and lack of geographical limitations, cryptocurrencies handle transactions far more quickly than traditional banking systems. Faster settlement times as a result enable firms to receive payments more quickly.

3) Access to a Global Reach

Small businesses can reach a global market of consumers that prefer digital currencies by accepting cryptocurrencies as payment, extending their customer base beyond traditional payment methods and geographic limitations. This creates chances to draw in tech-savvy, global clients that appreciate the privacy, security, and ease that cryptocurrency transactions provide. Adopting cryptocurrencies can also help small firms stand out from the competition and project an image of innovation and forward-thinking in the industry.

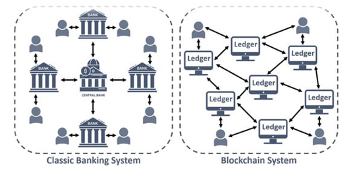

4) Enhanced Security

Blockchain technology, which uses cryptographic techniques to give a high level of security, is the foundation for cryptocurrencies. Because transactions are kept on a decentralized ledger, hackers find it very difficult to falsify or modify transaction data. Small businesses can be shielded from fraud and data breaches by this increased protection. Furthermore, immutability and transparency are guaranteed by blockchain technology, which means that once a transaction is registered on the blockchain, it cannot be altered or removed. The total security of financial transactions for small firms is improved by this trustless method, which also lowers the possibility of fraudulent activity.

5) Potential for Growth

The growing acceptance of cryptocurrencies presents a chance for small firms to get a competitive advantage. Taking cryptocurrency payments draws in tech-savvy clients who respect online shopping. This cutting-edge strategy gives companies a reputation for innovation and gives them access to a market of cryptocurrency users who are ready to spend their digital assets. In the end, adopting cryptocurrency can help businesses reach a wider audience and generate new sources of income.

Conclusion

In conclusion, with cryptocurrency, small businesses could never be the same! They save money on transactions, everything moves more quickly, and everything is safe. Additionally, it enables them to reach a global clientele. Their state-of-the-art technology offers them an advantage in the current digital industry. It not only saves expenses but also creates new opportunities for profit and demonstrates to all that they are at the forefront of technology.